Consider using a community-focused bank (Part I)

If you want to make a difference with your money, get to know some smaller banks.

The biggest banks in the US (those with more than $1 trillion in assets) put an average of $31 of every $100 in the bank into communities as community investments*, mostly in the form of loans for business, housing, construction, farms, and public works.

And when it comes to smaller banks?

The banks with less than $50 billion in the bank -- 99% of banks in the country -- put an average of $71 of every $100 in the bank into communities as community investments. That’s double the average of the biggest banks.

This means that if Small Bank A and Big Bank B are both working with $10 million in the bank, Small Bank A invests $4 million more into communities than Big Bank B. That’s 40 small business loans of $100,000 each.

Imagine you’re walking down a street where 40 storefronts each received $100K in working capital as a loan, versus another street in which those loans weren’t made.

Which street would you rather stroll on a Saturday? Close to which street would you prefer to own a home? If you like to see storefronts occupied and your property value increasing, we assume you’d vote for the street where the small business loans were made.

Here’s a view of the community investing focus of the bank industry, divided out by bank size.

Average number of dollars that banks of different sizes invest in communities, for every $100 in the bank

Dollar for dollar, banks with less than $50 billion in total assets — again, 99% of all banks — put more financing into communities than the 45 or so banks with more than $50 billion in total assets.

Even the smallest banks in the country -- those with less than $250 million in total assets — put more money, dollar for dollar, into communities than banks more than 200 times their size.

Another way to look at this is to consider the 100 individual banks in the US that put more of their total money into community financing than all the rest.

These banks invest $92 or more of every $100 in their banks into communities. We’ve charted these banks by bank size, below.

The 100 banks that put the most of their money into community financing, grouped by bank size. Chart shows the percentage of banks in each asset class.

None of the top performing community-investing banks have more than $50B in assets.

How about banks that focus on financing important modern issues, like racial equity?

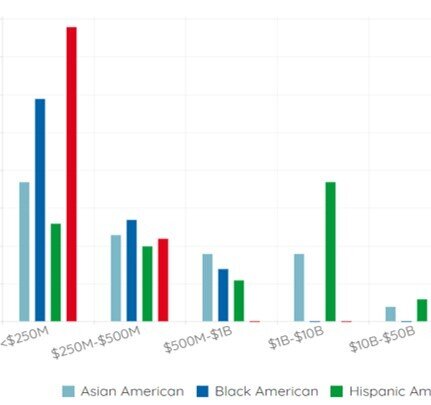

Banks certified for financing racial equity in the US, grouped by bank size.

Chart shows the percentage of banks in each asset class.

The US government certifies banks that contribute to the advancement of racial equity both through their ownership and governance structure (banks majority owned and/or governed by people of color) and through their part in serving communities of color.

None of these banks are larger than $50 billion in total assets, and the majority have less than $500M.

For banks focused on financing poverty alleviation, women’s equity, and sustainability, the pattern holds.

Banks focused on financing areas of impact, grouped by bank size.

Chart shows the percentage of banks in each asset class.

Banks certified for their sustainability financing focus are likely to have somewhere between $1 and $10 billion in assets.

All banks in the US certified for their roles in funding poverty alleviation (certified Community Development banks) have less than $10 billion in assets.

Most banks owned by women have less than $250 million in total assets.

To sum it up: Banks that are smaller in size seem to have lending and governance structures that enable them to focus on funding important communities and causes that may otherwise be overlooked by the largest banks as a priority line of business.

If you want your money to finance communities and issues like sustainability and poverty alleviation, smaller banks are more likely to direct more of your money toward these efforts.

See how your dollars in different banks stack up

*For this analysis, Mighty defined dollars invested into communities as dollars in: small and large business loans, small and large farm loans, household loans (including automobile loans, student loans, and other consumer loans), construction loans, housing loans, and public works loans and securities.