How to Calculate Your Impact

Get your baseline of what your money is doing across banks

1. Enter the names of your banks, along with the estimated amount you have in deposits (checking, savings, money market, CD, retirement accounts) with each

Mighty needs to know the relative amount (% or $) of money you have with one bank versus another in order to weigh the influence of one bank versus another in your portfolio.

*Note: Your impact assessment is an estimate, based on publicly available data.

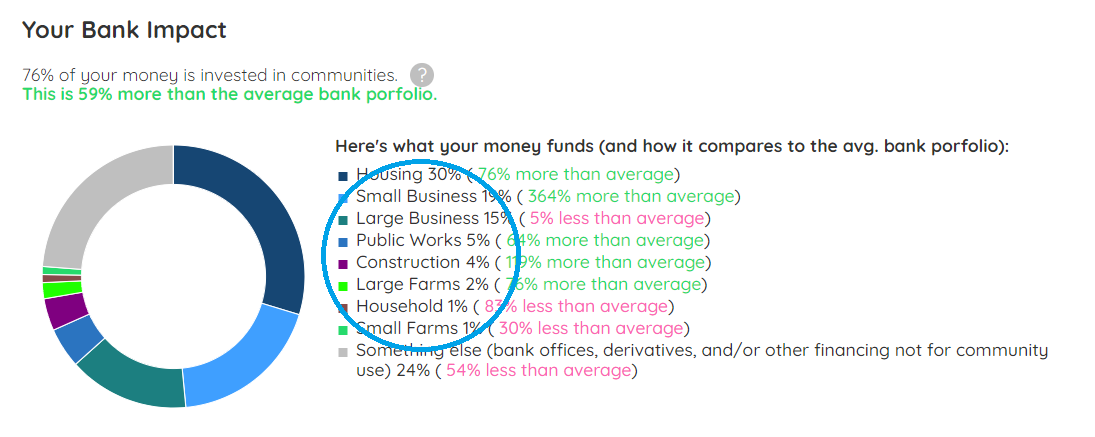

2. Click “Calculate My Impact” to see detail about what your money funds

Metrics are contextualized in green (above industry average) or pink (below industry average).

3. Select ‘Show Details’ / ‘Hide Details’ to see your portfolio’s performance over time

4. Review the certified impact causes you finance

If you’re interested in building your financing in a particular impact area, consider increasing your share of money kept in banks certified for that area, or adding banks in that area to your portfolio.

Click on the hyperlinks to browse banks that stand out for financing impact causes.

5. Click the ‘Learn More’ button to learn more about the banks in your portfolio

6. Subscribe to get access to updated data about your bank portfolio as it’s published by the government (about once a quarter)

We’ll also notify you when new metrics about your portfolio’s performance are available on Mighty.

7. Model what your money could be doing

Once you have a baseline for what your money is currently doing, run simulations of what your money could be doing:

if allocated differently across your current banks

if allocated across different combinations of new banks